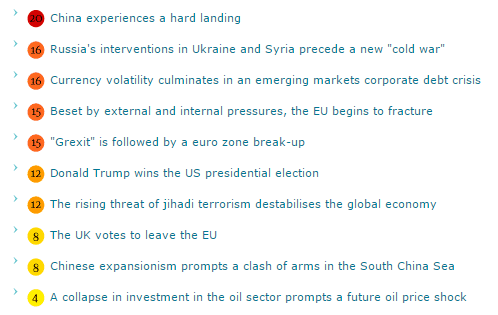

If you’re not a total political junkie like me (this is not a political post), then perhaps you should not. You are probably turning off every news channel and going into hiding till this long drawn out process is over and I don’t blame you. However, the election process and the results of it have a significant impact on overall risk management for each of us professionally. The Economist recently published their Global Risk assessment and a certain candidate’s presidency is ranked higher than a Brexit, jihadi terrorism and a military fight with China!! Seriously.

Their logic is that various trade agreements (TPP) and trade policies would drastically change given that he is against free trade, his hostility against China and Mexico as trading partners will have serious repercussions, his stance against Muslims could increase recruitment for terrorists and thus increase global risk etc. All of these are major issues that need to be incorporated into your overall risk model at some time because they will disrupt commercial relationships and supply chains. Anecdotally, I can also add the possibility of a serious brain drain from the U.S. as I keep running into lots of discussions amongst immigrant professionals who are openly debating going back to their native countries because of potential hostility and violence and/or equally lucrative opportunities back home. And by the way, some of these impacts are already being felt as part of his candidacy, not his presidency.

And to be fair and balanced, if someone like a candidate from the other party wins, there are different but equally significant shifts in risk that must be accounted for. He is equally opposed to the various trade agreements. A number of his policies will mean a fundamental restructuring of various sectors of the economy. Free public college will shake up the education sector like never before. His foreign policy of “least intervention” will mean a structural shift in the defense industry. Healthcare and the associated insurance industry will not be recognizable. The Financial sector will go through a metamorphosis like we have never seen. All of these will have a sizeable critical impact on all commercial relationships and risk management.

While it is fair to say that professionally we cannot have an impact on the process or the results, we must be paying attention and start looking at the potential impacts of their declared policies and start preparing for them. To be fair, the President cannot impose policy without Congress and therefore the checks and balances in place will certainly modulate any drastic impacts. Depending on what sector of the economy you are in, it may be prudent to at least start putting together initial “what if” scenarios keeping in mind that any impacts of any new policies will take a while to materialize. For example, if a significant portion of your customers are from the defense sector, it may be prudent to start analyzing what your strategy will be if that segment starts declining rapidly. If there is a big push to insource, how will that impact your supply chain and overall costs?

While you may not care who wins the election or even the nomination on a personal level, you may want to leave the news channel on because there are going to be some significant potential disruptions to commercial relationships and supply chains.

The Economist Intelligence Unit (EIU) ranks global risks on a scale of one to 25: