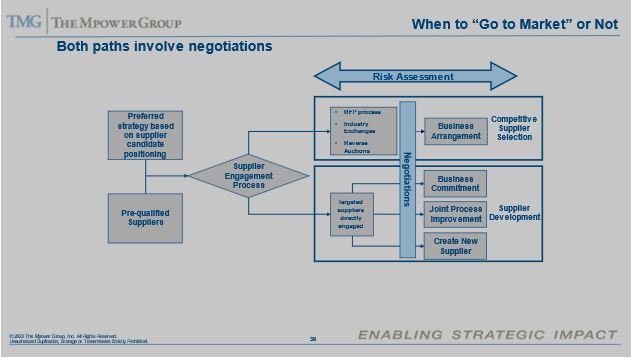

Who would have thunk that Hamlet would show up in this blog but here we are. This question of whether we should go to the supply market for a category or just strike a new deal with the incumbent is faced by every single Category Manager. And they are often perplexed by not knowing how to approach that decision. Let’s put things in perspective first. You still have to follow the Strategic Sourcing process up to this decision point. You have to gather and evaluate business requirements; you have to assess the supply market and only then do you decide whether to go to the market or try and get a new deal with the incumbent. We call that the Supplier Engagement Path where you are trying to decide whether to go down the path of Supplier Development (Incumbent) or a competitive process (go to market). And obviously, you have to factor in the level of risk and cost associated with switching suppliers.

The one myth that people have is that if you follow the Supplier Development path, you give up on negotiations and nothing could be further from the truth. You will still ensure that you are getting a market competitive price based on the intelligence that you have gathered. Here is an illustration:

Please note that both paths involve negotiations and based on negotiation results, the strategy may shift. For example, if supplier development is unsuccessful, it may be necessary to reopen the competitive supplier selection process.

But, before you make the decision to go down the Suppler Development Path, here are a number of Key Questions that must be answered in the affirmative:

- Do we know enough about potential technological alternatives that we are confident that we will choose the suppliers with the most appropriate technology

- Do we know enough about the supply market to know that we are not leaving the best suppliers out

- Are we certain who are cost competitive today and in the future

- Do we know what kind of relationship we want (term; tactical vs. strategic etc.) and can supplier support that type of relationship

- Can incumbent handle current and future volumes

- Are stakeholders confident in this supplier

- Do we have a clear understanding of what a good price is? (e.g., competitive price benchmarks, “should costs target price”)

- Do we believe that we can negotiate the necessary improvements to achieve our cost targets without further competitive threat?

- Are the risks (after mitigation) associated with switching from this supplier reasonable and acceptable?

- Are the costs associated with switching reasonable and acceptable?

- What is the size of the gap between current and desired performance? Are we confident the supplier can close that gap?

If you follow a disciplined and rigorous process, there is no reason to think that you are giving up any type of competitive leverage and you can and should still negotiate aggressively to achieve all your Stakeholder Value Drivers. What you need to do is the ensure that you have certainty about supplier capabilities to ensure you’re not leaving th best suppliers out; clarity about the type of relationship that you want and ensure you have negotiating power to drive cooperation from the incumbent.

And of course, you always want to make sure you have a contingency plan in place to go to market. So, establish clear goals and objectives with the supplier including a work plan and schedule to reach a conclusion so that you can move on to a competitive process, if needed. The best solution is to stick with the incumbent while ensuring you are meeting as many of your Stakeholder Value Drivers thus reducing the risk of switching suppliers?