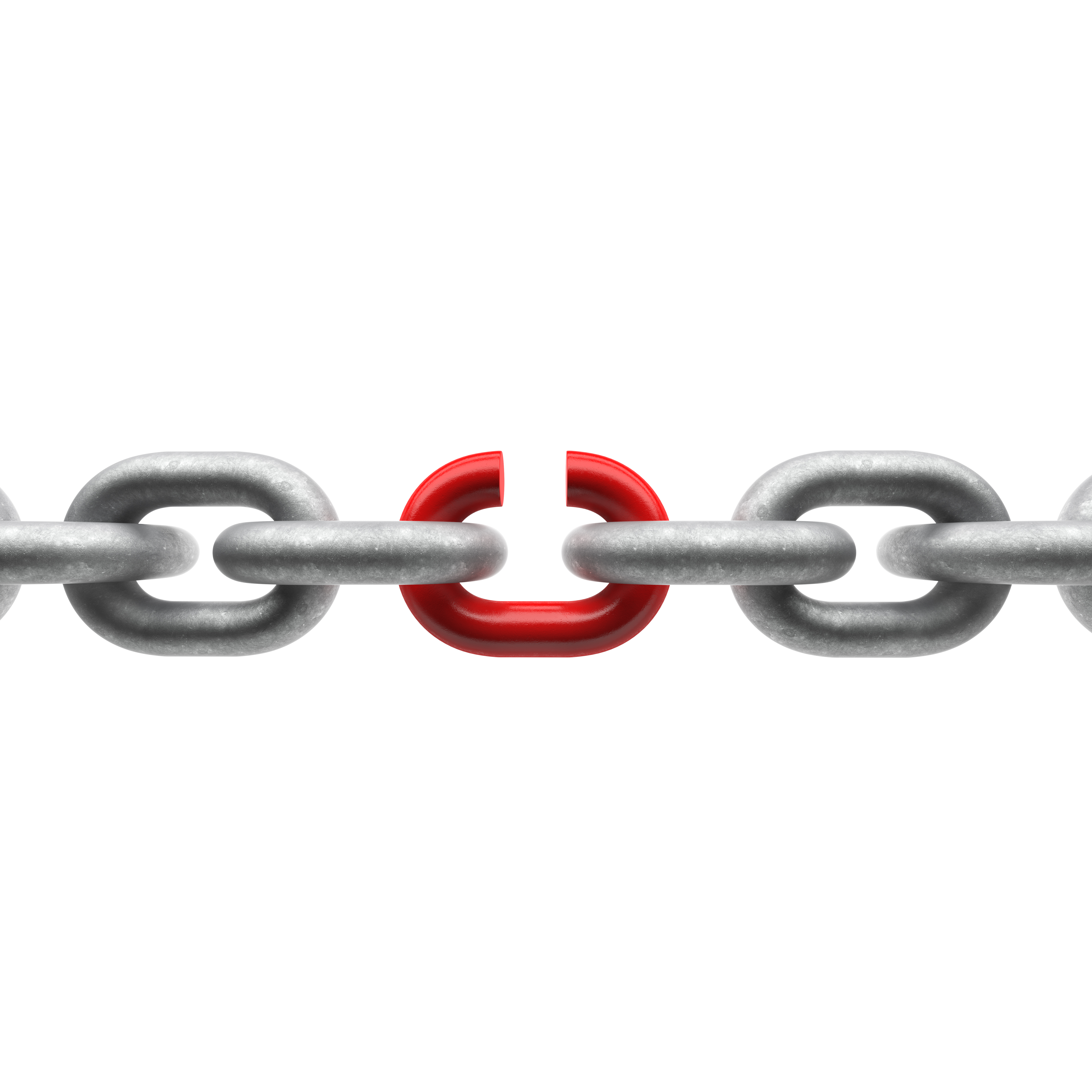

Xuhua is a dropout from UCLA (PhD program) and has caused Lumber Liquidator’s (“LL”) to drop 2/3 – YES, 2/3 of its market cap (from $3bn to $1 bn) within a year! He noticed a significant increase in their profitability compared to the industry, and in investigating why, discovered that their Supply Chain had a major risk exposure – mainly that LL had cut their supplier prices by buying flooring that violated safety standards – too much formaldehyde. In addition to the loss of $2bn in valuation, LL was just featured on 60 minutes, the Senate has launched investigations, class action suits are being filed by investors AND consumers and their market share is diving….and the troubles have just started. Ultimate survival of LL may be at stake.

For those of you who follow our research or are clients or alumni will remember our initially much aligned series called “Strategic Sourcing is Dead” and if not, it should be from a few years ago when we started preaching that the relentless cost focus of sourcing efforts was actually destroying value and Supply Chain/Sourcing organizations were headed for extinction unless they changed. This is another example of a long list of organizations that continue to prove our point – and we wish we had been wrong.

Those that look at Supply Chain risk for their organizations should definitely take note of this new phenomenon – professional short sellers who are looking at your supply chain today, identifying risks that you may or may not know of and then exploiting those risks where it can pose an existential threat to your company- unless you are better at identifying and managing those risks. Meet Whitney Tilson, founder of Kase Capital Management, who found Xuhua’s research, took it public and to 60 minutes while going short on the stock in anticipation of a major drop in share prices. He has already made a killing.

While LL is trying to do as much damage control as possible, in the world of PR and reputational risk, if you are defending yourself and attacking the testing methodology used by investigators, defending your companies actions by saying you meet the standards (when you clearly don’t) and challenging the accuracy of what your suppliers are saying on TV – it’s a lost cause.

These types of risks in offshore outsourcing (Apple-Bloomberg) have been known for a long time (Toyota-USA Today) and therefore even if the market buys LL’s explanation that it did not know about this (despite suppliers saying that LL knew about it), the market is likely to still hold LL totally accountable and responsible. The suppliers were clearly not meeting safety standards yet stamping the product as if they did meet standards.

The discussion that was started about pursuing a low cost strategy is still valid . The Next Practices version of sourcing must identify the real Value Drivers of the company and then relentlessly make sure that the executives support this fundamentally different version of the sourcing process. The days of putting undue pressure on suppliers to meet totally artificial “should cost” targets are long gone and the sooner we as a profession realize it, the better our companies will be. This fundamental shift has to occur and has to be Adopted by the organization or elsewe will continue to expose our companies to the types of existential threats that we cannot imagine. Of course, this shift also requires a shift in the types of competencies we have but if you are a reader of this blog, you already knew that 🙂 .