A recent spate of news around this topic makes this an opportune time for this discussion. Any Category Management (CM) strategy (and for this discussion we will talk about outsourcing offshore as the CM strategy) MUST have an exit ramp as an integral component. The reason that offshoring is part of your strategy is because it offered some kind of arbitrage (labor cost, lead time, easier regulations, favorable tarrifs etc.) and ALL arbitrage is temporary and transitionary in nature. Therefore, you will have to exit that strategy at some time (it is a Predictable and Inevitable fact!!!) and the best time to prepare for it is to make it a part of your initial strategy.

Let me start with challenging a few comments that were published this month in Forbes. This was in reference to companies considering shifting suppliers from China because of the trade war. “Should they stick with the status quo or seek alternative locations to make and source supplies?” “Uncertainty has become the new normal for many U.S. companies facing supply chain disruptions,” What struck me was that this is the wrong question to ask and the wrong time to be asking that question. It’s not about should but when and therefore the question should be asked at the time of outsourcing to China – or anywhere else for that matter. And I’m not sure uncertainty will ever be a new normal – supply chain disruptions are normal – they are Predictable and Inevitable for well versed professionals or Level 5 mature organizations in our field!

The article goes on to say.“The trade war is forcing companies to do things they should be doing anyway, like strategic sourcing, competitive bidding, deal negotiations and so on. Now is the time to make an investment in the supply chain team, ensuring a leader with a strong strategic focus is on board.” With all due respect to the esteemed author, that’s like putting the cart before the horse or the horse has already left the barn or something like that. If companies had already made an investment in their supply chain and had a strong leader with a strategic focus, they would probably not be in this situation. They would already have built an occurrence like this in their initial CM strategy and have determined what time they would follow the shifting arbitrage to another location. They would make sure their pants stayed up 😊.

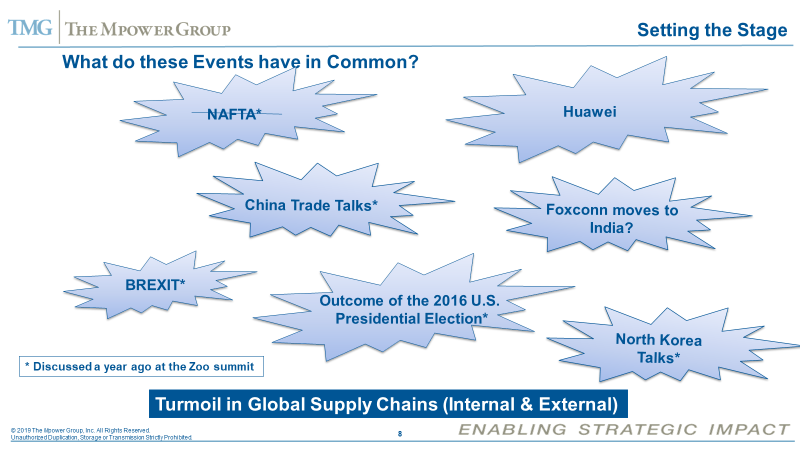

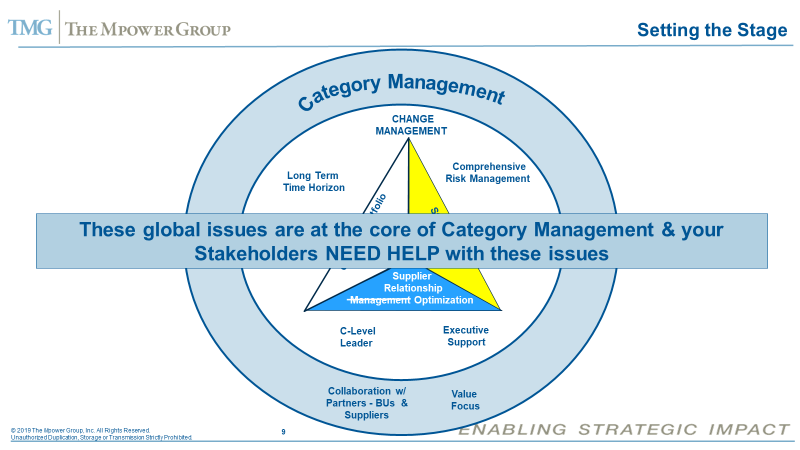

The following slides are from a recent workshop we hosted- The Impact of Trade Talks, Tariffs and Global Turmoil on our Category Strategies – Time to get in Front of this Major Risk!

If you are doing CM, then none of this should be a surprise

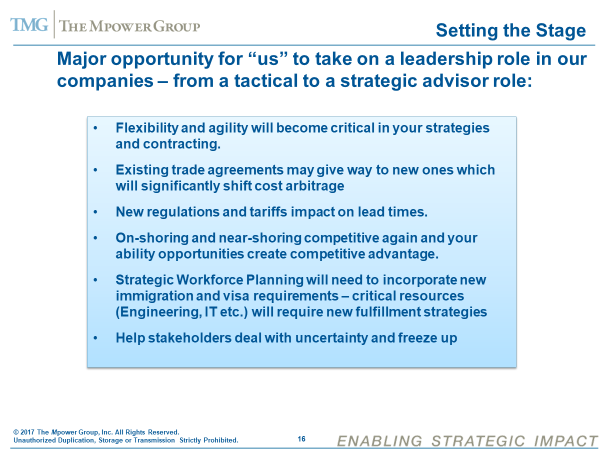

The following slide is from another one of our workshops – “Black Swan” Risk Management- Mitigating Sudden Changes In Trade, Immigration & Foreign Policy which was held in 2017 and I know I can go back further to find similar references in our archives. Every single bullet is applicable to the situation that the article (China trade war) says is catching people by surprise (my interpretation)

And all you have to do is take a look at this slide and hopefully agree with my point – none of what is happening should be a surprise under any definition of CM? These are all Predictable and Inevitable issues that should be incorporated into our CM strategies. We should have some type of decision criteria and monitoring process as part of our CM strategy under which a deeper analysis would be triggered. Whatever arbitrage assumptions were made when the decision to offshore/outsource were made should be incorporated into the exit decision model and validated with the stakeholders when the initial CM strategy is being developed. Those above-mentioned criteria/model should also feed into your Supplier Optimization Process and the underlying metrics supporting it allowing you to monitor them and ensure supplier focus on them. After all, the goal is to extend the arbitrage window for as long as possible and NOT have to shift your supply chain.

Do you build your exit strategy into your initial strategy? Should you? Or are you assuming that the arbitrage will not shift? Will you be caught with your pants down or up?